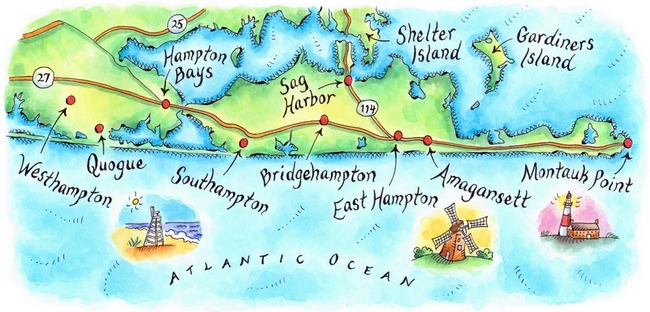

August is famous for senior Wall Street traders vacating their desks for their younger brethren and seeking the solace and serenity of the Hampton's and its beaches. Their return after Labor Day is regarded as akin to 'the adults are back' and the market will find its true direction as a result. Most analysts discount market behavior during their absence. Trading volume is typically thinner than the rest of non-holiday trading sessions and, as a result, market volatility can and does increase. As the more senior members of trading firms make their way back, volumes usually increase and the direction of stocks and bonds for the rest of the year can be better gauged. Will this year be any different or will tradition hold to form?

August is famous for senior Wall Street traders vacating their desks for their younger brethren and seeking the solace and serenity of the Hampton's and its beaches. Their return after Labor Day is regarded as akin to 'the adults are back' and the market will find its true direction as a result. Most analysts discount market behavior during their absence. Trading volume is typically thinner than the rest of non-holiday trading sessions and, as a result, market volatility can and does increase. As the more senior members of trading firms make their way back, volumes usually increase and the direction of stocks and bonds for the rest of the year can be better gauged. Will this year be any different or will tradition hold to form?

The Fed's Eventual Exit

This fall will be different than recent falls. This year will see the end to the Fed's Quantitative Easing program. In October, the Fed will eliminate its asset-purchasing program by reducing purchases by $15 billion. The market has not had a fall season without some form of Fed intervention since 2008. Already, the market is witnessing some turbulence. Yields on the US 10-year treasury have backed up about 25 bps, and since hitting the 2,000 milestone in late August, the S&P 500 has hit the proverbial wall. This year, the only evidence reflecting the return of senior staff may be increased volumes. The other dynamics in the market make it very difficult to isolate the influence of senior traders. Between the Fed, overseas conflicts, and moves made by the European Central Bank (ECB), not to mention that 2,000 reflects the upper end of most analysts equity forecasts for the S&P 500, differentiating between junior and senior traders will be difficult.

Improving Economic Data

Since Labor Day, economic data has been coming in positive. One of the market's more frustrating aspects is its ability to behave in a counter-intuitive manner. As economic data improves, the expectation would be that markets behave accordingly, with equities benefiting the most. However, this is not always the case, and since Labor Day, equities and bonds have stalled as the data continues to improve. This "good news is bad" is one of the markets quirks. As mentioned above, equities have stalled around 2,000 in the S&P 500 and yields have backed up on US Treasuries. One of the results of higher rates are their impact on mortgage application volume. The Mortgage Bankers Association (MBA) has reported that their index for mortgage applications is at a 14-year low, with refinance applications taking the biggest hit followed by purchase applications. The average conforming 30-year fixed mortgage loan rate is 4.27%, up only modestly since Labor Day, but enough to dent applications. This reflects how "tight" the refinance market is, when a small change in yields is enough to affect total loan volume.

A More Sober Approach?

Dusting the sand from their shoes, will traders take a more measured approach to the final quarter of the year? With conflicts in the Ukraine and the middle east, and President Obama's handling of the ISIS crisis in Iraq squarely in focus, senior traders may decide to adjust their ebullience, and rein in expectations for further market gains. With many analysts moving up their expectations for a rate hike by the Fed, yields are moving up in anticipation. If the market is a discounting mechanism and looks forward six months, a rate hike should start to be priced in to markets and the impact on equities and other markets could be felt for the remainder of this year. With the markets rebounding from a slight malaise in early August that saw the S&P 500 test 1,900, traders seem satisfied with current levels. The perspective from here is that further gains in the markets will be limited and mild at best, as the reality of the end of the Fed's unprecedented intervention settles in.

This fall will be different than recent falls. This year will see the end to the Fed's Quantitative Easing program. In October, the Fed will eliminate its asset-purchasing program by reducing purchases by $15 billion. The market has not had a fall season without some form of Fed intervention since 2008. Already, the market is witnessing some turbulence. Yields on the US 10-year treasury have backed up about 25 bps, and since hitting the 2,000 milestone in late August, the S&P 500 has hit the proverbial wall. This year, the only evidence reflecting the return of senior staff may be increased volumes. The other dynamics in the market make it very difficult to isolate the influence of senior traders. Between the Fed, overseas conflicts, and moves made by the European Central Bank (ECB), not to mention that 2,000 reflects the upper end of most analysts equity forecasts for the S&P 500, differentiating between junior and senior traders will be difficult.

Improving Economic Data

Since Labor Day, economic data has been coming in positive. One of the market's more frustrating aspects is its ability to behave in a counter-intuitive manner. As economic data improves, the expectation would be that markets behave accordingly, with equities benefiting the most. However, this is not always the case, and since Labor Day, equities and bonds have stalled as the data continues to improve. This "good news is bad" is one of the markets quirks. As mentioned above, equities have stalled around 2,000 in the S&P 500 and yields have backed up on US Treasuries. One of the results of higher rates are their impact on mortgage application volume. The Mortgage Bankers Association (MBA) has reported that their index for mortgage applications is at a 14-year low, with refinance applications taking the biggest hit followed by purchase applications. The average conforming 30-year fixed mortgage loan rate is 4.27%, up only modestly since Labor Day, but enough to dent applications. This reflects how "tight" the refinance market is, when a small change in yields is enough to affect total loan volume.

A More Sober Approach?

Dusting the sand from their shoes, will traders take a more measured approach to the final quarter of the year? With conflicts in the Ukraine and the middle east, and President Obama's handling of the ISIS crisis in Iraq squarely in focus, senior traders may decide to adjust their ebullience, and rein in expectations for further market gains. With many analysts moving up their expectations for a rate hike by the Fed, yields are moving up in anticipation. If the market is a discounting mechanism and looks forward six months, a rate hike should start to be priced in to markets and the impact on equities and other markets could be felt for the remainder of this year. With the markets rebounding from a slight malaise in early August that saw the S&P 500 test 1,900, traders seem satisfied with current levels. The perspective from here is that further gains in the markets will be limited and mild at best, as the reality of the end of the Fed's unprecedented intervention settles in.

No comments:

Post a Comment